steverboss wrote: ↑Thu Mar 02, 2023 1:55 pm

Simple answer, I can buy a small piece of HDPE (6 inches by 24 inches) that’s hopefully enough for 2 inserts for about $20. But I do have scrap hard board laying around. Thus my question about HDPE vs Masonite. I have zero Baltic birch laying around.

Yeah, but that is expensive relatively - it is just that you are buying a small quantity. HDPE should be a great choice. I personally don't like Masonite/hardboard.

On an adjacent topic, Baltic Birch plywood is so expensive because of the Ukraine War. The dominant suppliers of Baltic Birch are Finland and Russia. Due to US sanctions on Russia, the cost of Baltic Birch plywood has skyrocketed here, which as Dennis pointed out has spurred domestic suppliers to potentially fill the gap

finally. I am glad to hear that because honestly I didn't want to buy any more Baltic Birch plywood while the war in Ukraine is still going on because it supports Russian oligarchs. Not surprising that domestic lumber suppliers would jump into the fray since they are

highly profit driven and like to manipulate markets themselves (pandemic run-up in lumber futures) as I reported in a past thread:

viewtopic.php?p=283403#p283403

RFGuy wrote: ↑Tue May 11, 2021 8:58 pm

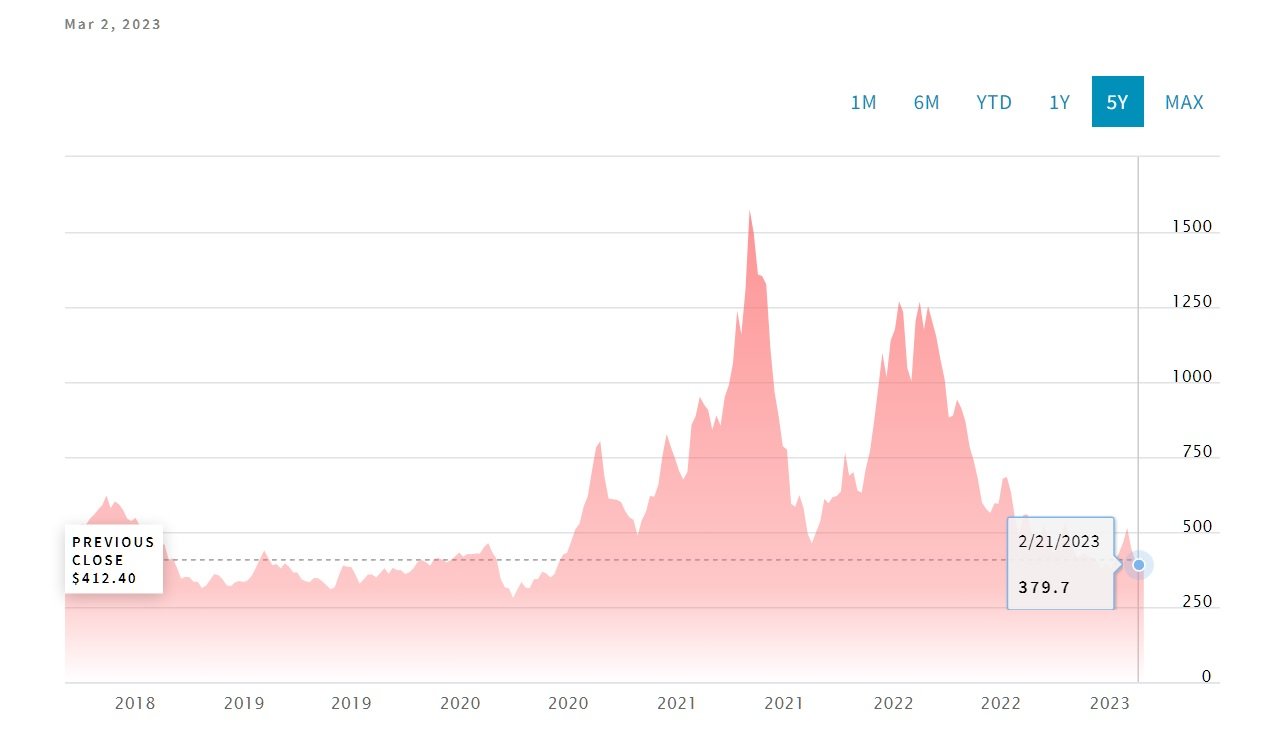

Yeah, I saw something else online that indicated the top 5 lumber producers in the USA are Georgia Pacific, Interfor, Sierra Pacific, West Fraser and Weyerhauser. So, G-P and S-P are private companies, but the rest are publicly traded companies so financials are available. So, Weyerhaeuser just reported $1.1B in profit for Q1 2021, versus $413M in Q1 2020. West Fraser reported $665M in profit for Q1 2021 compared to only $9M in Q1 2020. Interfor had record profit of $392M in Q1 2021 compared to $36.6M in Q1 2020. Wondering if price fixing is a possibility here. I mean from what I understand the landowners aren't making out right now, e.g. logs sold continue to be at the lowest price in a couple of decades. So, the owners of the trees aren't seeing any more money from this. I don't believe small sawmills and truck drivers are making that much more, other than maybe some overtime pay. It's possible that the big box stores (Home Depot, Lowes, Menards, etc.) are profiting from this, but I find it hard to believe they could get away with this due to competition between them. So, that really just leaves the large sawmills/warehousers like the top 5 listed above. Don't get me wrong, I know there is increased demand, but I don't believe the supply<->demand dynamic at present indicates a 4x run up in lumber futures prices. I do believe the vast majority of this increase in lumber prices is going directly to benefit these top 5 lumber producers. The year-on-year quarterly profit for Interfor went up like 10x, but West Fraser's went up 74x. Weyerhauser only went up like 2.5x. We'd have to get into any special one-time expenses for these companies to validate if their last year's profit was reduced for some reason. In addition, we would have to look at how much volume of product they shipped this year versus last year, but....does anyone think actual lumber demand in the USA is so high to justify a 10x or more increase in profit for these lumber companies???

P.S. Lumber Futures are FINALLY back down to where this commodity should be:

- LumberFutures_3MAR2023.jpg (46.1 KiB) Viewed 1346 times

Now I know why you are called Dusty.

By the way, Masonite is just a brand name, so if they are not buying that brand, they must just call it “hard board”.